Have you ever wondered what would happen if life threw an unexpected curveball your way? From sudden health issues to unforeseen home damages, these events can be daunting, but this is where insurance solutions come in to save the day.

In this blog post, we’ll explore various types of insurance and how they can provide a safety net when you need it most. By the end, you’ll have a clearer understanding of the best insurance solutions tailored to your needs, ensuring peace of mind and financial security.

Health Insurance – Your Safety Net

Let’s kick things off with health insurance. You know, that magical card you whip out when you need a doctor’s visit or, heaven forbid, a trip to the emergency room.

It’s like having a superhero cape tucked away in your wallet. Health insurance helps cover the costs of medical care, so you don’t have to drain your savings or skip treatment because of money worries. Trust me, it’s a game-changer.

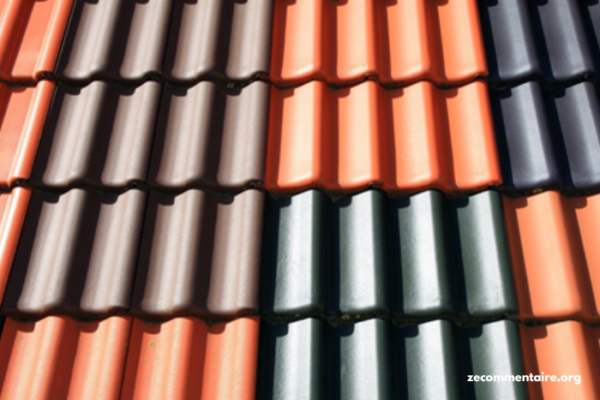

Homeowners Insurance – Peace of Mind for Your Pad

Now, let’s talk about homeowners insurance and asset protection. Imagine this: you’re relaxing on the couch, enjoying your favorite show when, suddenly, a leaky pipe transforms your living room into a swimming pool.

No need to panic! Home insurance provides backup, protecting your home and belongings from unexpected disasters like fires, burglaries, or even leaky pipes.

Oh, and if you’re scratching your head about what to do after your homeowners insurance gets the boot (ahem, homeowners insurance after non renewal), don’t sweat it. There are still options out there to keep your castle covered.

Auto Insurance – Safeguarding Your Wheels

Now, let’s talk about everyone’s favorite four-wheeled friends: cars. Whether you’re cruising down the highway or navigating city streets, auto insurance is your trusty sidekick.

It steps in to cover the costs if you get into a fender-bender or, heaven forbid, a more serious accident. Plus, in many places, it’s the law to have auto insurance, so it’s not just a good idea – it’s a must-have.

Life Insurance – Protecting Your Loved Ones

Let’s talk about life insurance. It’s not the most fun topic, but it’s crucial, especially if your loved ones depend on you financially. Life insurance provides a safety net for your family if something happens to you. It can cover funeral expenses, and debts, and provide financial support.

Imagine the peace of mind knowing your family won’t face financial stress in an already difficult time. Life insurance can ensure your children’s education is funded, your mortgage is paid off, and your family’s standard of living is maintained. It’s a way to show your love even after you’re gone. Taking this step ensures your legacy is one of support and protection.

Embracing the Power of Insurance Solutionsand

In conclusion, insurance solutions are essential for safeguarding your health, home, vehicle, and loved ones. They offer a reliable safety net when life’s uncertainties arise, ensuring that you are financially protected and prepared for the unexpected.

By understanding and embracing these insurance solutions, you can secure peace of mind and focus on what truly matters in life. So, invest in the right policies today, and trust that your team of superheroes has got you covered every step of the way.

Keep browsing our website for more helpful articles!