In today’s fast-changing world, businesses are always looking for ways to grow and succeed. A big part of this success comes from the Chief Financial Officer (CFO).

CFOs are experts in handling money and planning for the future. They create smart strategies that help businesses run smoothly and grow over time. Good CFO management strategies can help companies earn more and stay ahead of their competition.

So, how can a CFO make a big difference? Let’s explore some of the best ways they do it!

Streamlining Budgeting Processes

A good budget helps a business use its money wisely and track its progress. CFOs should create flexible budgets that can change as needed based on current data.

Checking the budget often is important. If something is off, they can fix it before it becomes a big problem. Using smart tools to predict income and expenses helps businesses stay on the right path.

Enhancing Cash Flow Management

Cash flow is like the heartbeat of a business. A CFO needs to manage it well to keep the company running and growing.

By checking cash flow regularly and planning ahead, CFOs can spot problems early and make smart choices to keep the business financially strong.

Implementing Financial Planning

Creating a strong financial plan that matches a company’s goals is very important. CFOs should check the plan often to make sure it still works and make changes when needed.

Making smart investment choices is also key. CFOs should carefully study each opportunity to see if it will help the company grow. By understanding risks and rewards, they can make decisions that keep the business successful and profitable.

Leveraging Technology

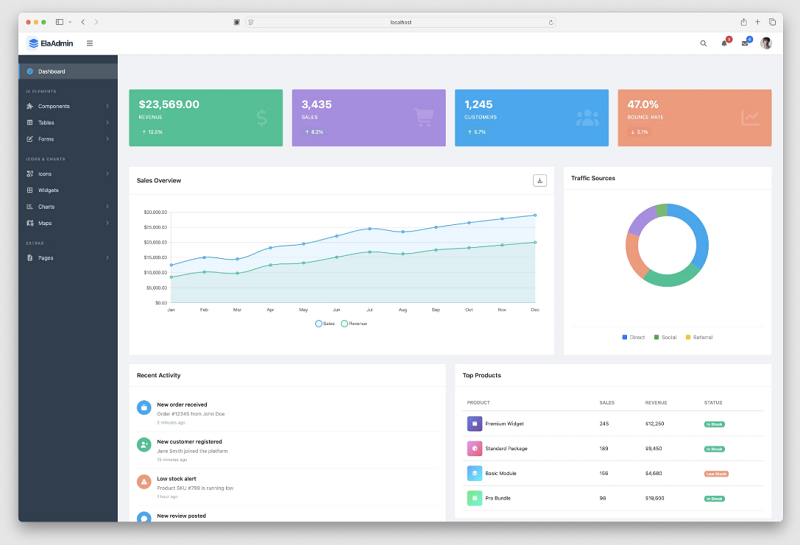

Embracing financial technology tools can enhance efficiency in data collection, reporting, and analysis. This enables CFOs to focus on strategic rather than administrative tasks.

To fully optimize these strategies, many companies turn to external expertise. Aligning with firms that provide AppFolio consulting services can deliver specialized knowledge in areas like budgeting, cash flow analysis, and financial planning.

Such partnerships can extend the capabilities of internal finance teams. This provides insights that drive significant business impacts.

Fostering Cross-Functional Collaboration

Working with different teams, like marketing and operations, helps a company stay on track with its financial goals. When everyone works together, the business has a better chance of growing.

Good financial planning helps companies make more money and run smoothly. CFOs who focus on this can improve profits and keep the business strong.

A big part of a CFO’s job is to prevent money problems before they happen. This means checking for risks, setting up strong rules, and following financial laws. Planning ahead helps keep the company safe and successful.

Final Thoughts on CFO Management Strategies

Mastering CFO management strategies is essential for driving business growth. By focusing on budgeting, cash flow, and long-term financial planning, CFOs can provide businesses with a solid foundation for success. As the financial landscape continues to evolve, staying ahead of trends and technology will empower CFOs to strategically position their companies for sustained growth.

Ensure your business thrives in today’s dynamic environment.

For more business tips, check out our blog posts.