As cryptocurrency adoption grows, businesses and freelancers are increasingly exploring ways to integrate digital assets into their payment processes. One such innovation is the crypto invoice, a tool that facilitates seamless transactions using cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and stablecoins. This article will explore the concept of crypto invoicing, its benefits, how it works, and the best platforms available for generating crypto invoices.

What is a Crypto Invoice?

A crypto invoice is a digital payment request that allows individuals or businesses to accept payments in cryptocurrency. Like traditional invoices, it details the payment amount, due date, and payment method but specifies cryptocurrency as the preferred payment medium. Crypto invoices are often generated using blockchain-based platforms that provide secure and transparent transactions.

Benefits of Using Crypto Invoices

- Global Accessibility – Crypto invoices eliminate barriers related to cross-border transactions, enabling businesses to receive payments from anywhere in the world without currency exchange hassles.

- Lower Transaction Fees – Compared to traditional banking or PayPal fees, crypto transactions typically incur lower fees, making them cost-effective for businesses and freelancers.

- Faster Payments – Cryptocurrency transactions settle faster than traditional banking transfers, reducing waiting times for payments.

- Security & Transparency – Transactions recorded on the blockchain ensure security, immutability, and full transparency.

- Eliminates Chargebacks – Unlike credit card payments, crypto payments are irreversible, reducing the risk of fraudulent chargebacks.

- Support for Multiple Cryptocurrencies – Businesses can accept payments in Bitcoin, Ethereum, stablecoins (USDT, USDC), and other digital assets, providing flexibility for clients.

How Does Crypto Invoicing Work?

Crypto invoicing follows a straightforward process:

- Invoice Creation – The service provider or business generates an invoice using a crypto invoicing platform, specifying details like amount, currency, payment address, and due date.

- Invoice Delivery – The invoice is shared with the client via email, a link, or a QR code.

- Client Payment – The client pays the invoice by sending cryptocurrency to the specified wallet address.

- Transaction Confirmation – The payment is confirmed on the blockchain, ensuring transparency and verification.

- Funds Settlement – The receiver can choose to keep the funds in crypto or convert them into fiat using a crypto payment such as converting XLM to USD processor.

Several platforms enable users to generate and manage crypto invoices. Here are some of the top choices:

- BitPay – One of the leading crypto payment processors, allowing businesses to accept multiple cryptocurrencies and settle in fiat if needed.

- CoinGate – Supports various cryptocurrencies and offers easy integration with e-commerce platforms.

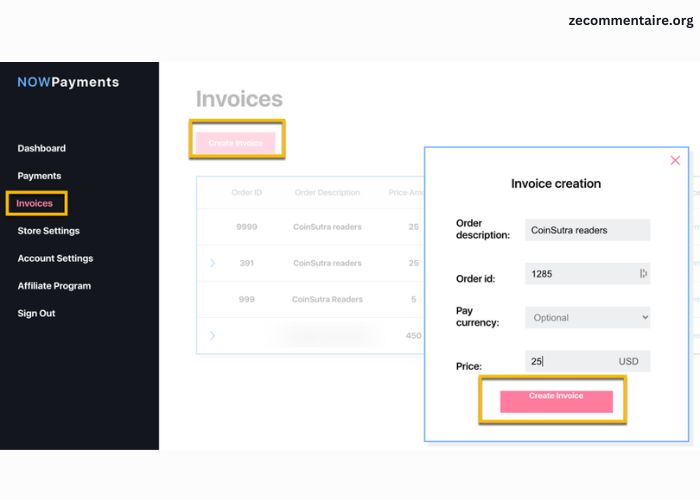

- NOWPayments – Provides non-custodial crypto payment solutions, including invoicing and auto-conversion.

- OpenNode – Specializes in Bitcoin and Lightning Network payments for instant and low-cost transactions.

- BTCPay Server – An open-source, self-hosted solution offering complete privacy and control over crypto invoicing.

How to Generate a Crypto Invoice Step-by-Step

- Choose a Crypto Invoice Platform – Sign up on a crypto invoicing platform like BitPay or CoinGate.

- Create a New Invoice – Enter invoice details, including recipient name, payment amount, and cryptocurrency type.

- Generate Invoice Link or QR Code – The platform provides a link or QR code for the client to make a payment.

- Send Invoice to Client – Share the invoice via email or direct link.

- Track Payment Status – Monitor blockchain confirmations and receive a notification once the payment is completed.

- Withdraw or Convert Funds – Withdraw the crypto to your wallet or convert it into fiat if required.

Use Cases of Crypto Invoices

Crypto invoicing is widely used in various industries:

- Freelancers & Remote Workers – Freelancers working with international clients use crypto invoices to receive payments without high transaction fees.

- E-commerce Stores – Online businesses accept crypto payments for products and services.

- Consulting & Digital Services – Agencies and consultants bill clients globally using crypto invoices.

- SaaS & Subscription Services – Software providers integrate crypto payments for recurring billing.

Challenges and Considerations

While crypto invoicing offers many advantages, there are some challenges to consider:

- Volatility – Cryptocurrency prices fluctuate, impacting the final value received. Stablecoins like USDT or USDC help mitigate this risk.

- Regulatory Compliance – Businesses must comply with tax and regulatory requirements related to crypto transactions in their jurisdiction.

- Customer Adoption – Some clients may be unfamiliar with crypto payments, requiring education on how to complete transactions.

- Security Concerns – Using a secure crypto invoicing platform and a reputable wallet is crucial to avoid scams and hacks.

Conclusion

Crypto invoices are revolutionizing the way businesses and freelancers receive payments by offering a fast, secure, and cost-effective solution. With growing cryptocurrency adoption, integrating crypto invoicing into your payment system can provide a competitive advantage, enabling global transactions with minimal friction. By choosing the right invoicing platform and following best practices, businesses can streamline their payment processes while embracing the future of digital finance.