Keeping track of oil stocks in India isn’t always easy. There are public sector giants like ONGC, private firms such as Reliance, and many others in between.

For most investors, sorting through all of it takes time and can feel confusing. That’s where stock screeners help. They cut through the noise and give you clear comparisons.

In this article, we’ll look at how screeners make tracking oil stocks much simpler.

Why Tracking Oil Stocks Is Challenging

Tracking oil stocks remains complex because their value depends on a web of volatile factors, including global crude prices, refining margins, currency fluctuations, and regulatory changes.

For instance, the BPCL share price may swing sharply if global oil prices spike. Indian oil companies rely heavily on imports, making them very sensitive to exchange rate shifts and evolving fiscal policy.

Sector indices can underperform even when some players outperform. Such complexity makes manual tracking tedious.

What Are Stock Screeners?

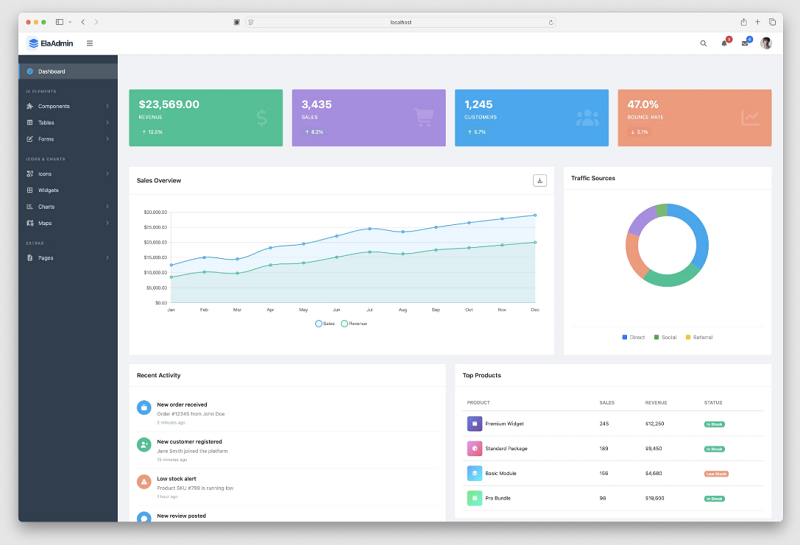

A stock screener works like a smart filter that helps investors sort through thousands of listed companies with ease.

Instead of reading every balance sheet or price chart, you set conditions such as price-to-earnings ratio, dividend yield, or market value. The tool then highlights only those stocks that fit the chosen rules.

Screeners are available on most broker platforms as well as independent websites, making research faster and investment choices more focused.

How Screeners Simplify Monitoring Oil Stocks

Here is how stock screeners make the task of monitoring oil companies easier and more structured.

1. Sector-specific Filtering

Using sector-specific filters helps investors zero in on the part of the oil and gas industry that truly matters to them.

Rather than getting overwhelmed by every listed player in the space, screeners let you focus on just one area, like exploration, refining, or fuel distribution. This way, you’re not comparing unrelated businesses, which makes the analysis cleaner and more useful.

Say you’re looking into ONGC or Oil India. You can simply apply a filter for upstream companies and skip the ones involved in refining or transportation.

2. Built-in Financial Filters

Screeners make it easier to evaluate oil stocks by offering built-in financial filters such as price-to-earnings ratio, return on equity, debt levels, and dividend yield.

With these built-in tools, investors can quickly filter companies that match their financial criteria without having to go through full annual reports or earnings sheets. Instead of comparing each company manually, users can apply relevant filters and reduce the list in seconds.

The result is faster analysis, better focus, and investment decisions that rely more on data.

3. Custom and Pre-made Screens

Most stock platforms now include both ready-made and custom screening tools, helping investors track oil-related companies more efficiently. With a free screener, you can quickly sort stocks by metrics like dividend yield, debt ratios, or earnings movement.

The pre-designed screens show common strategies in action, while the custom route gives more control to match individual investing styles.

This balance of speed and flexibility matters a lot in oil and energy markets, where staying alert to change often shapes better investment timing.

4. Real-time Updates and Alerts

Oil stock prices often react to global crude movements, currency swings, and regulatory changes. A free stock screener helps investors stay ahead by offering real-time updates and alert systems.

These tools send notifications when a stock breaks out, dips sharply, or reaches a set technical level.

Rather than watching charts all day, investors get customized signals that help them act quickly and make well-informed choices.

Conclusion

Stock screeners remove much of the uncertainty from tracking oil stocks. They allow investors to filter important data points and focus on specific segments. For anyone exploring India’s energy sector, these tools offer clarity and help uncover opportunities in a constantly shifting market.